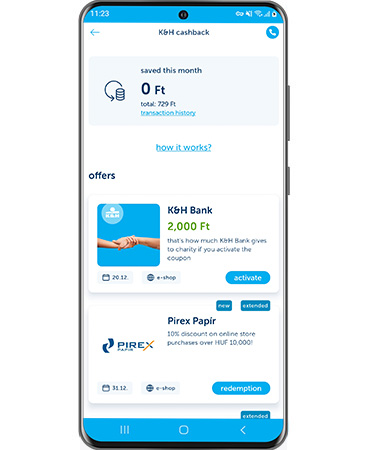

K&H cashback: money paid back for your purchases

- regularly updated & personalised offers and discounts

- pay with your K&H debit or credit card

- your refund is automatically credited to your account each month

if you already have a bank account with us

- all you need to do is activate the K&H cashback service and discover your personalised offers in the mobile banking app

- activate the offers you like

- use your K&H debit or credit card to pay for your purchase

if you do not have a bank account with us

- download our account opening app

- open your account anywhere, anytime

- activate the K&H cashback service

- use your K&H debit or credit card to pay for your purchase, & enjoy the discounts offered to you

reduce the cost of your purchases conveniently

- activate K&H cashback in your mobile banking app, or ask Kate for help and she will direct you to the right screen

- watch out for regularly updated offers and discounts tailored to your spending habits

- activate them with a single tap

- at this point you automatically become eligible for a refund, just use your K&H debit or credit card

- your refund will be credited to your account once a month

- activation and use of the service is free of charge

our past and current partners

frequently asked questions

what is K&H cashback and why do we recommend it to you?

K&H cashback is a refund service offered by K&H Bank, which allows you to get money back retroactively from purchases from our partners with your K&H retail bank card. Depending on the offer, this may apply to physical stores or online shops.

Activation and use of the K&H cashback service is free of charge.

which card payment will entitle me to a refund?

The service covers all HUF-denominated retail debit and credit cards specified in the Bank's Announcements applicable to K&H debit and credit cards for natural persons.

You can participate in the discount programme with your main card or a co-card. Refunds for purchases made with a co-card will be credited to the main cardholder’s account to which the co-card is connected.

The service and/or its offers are not available with the following cards:

- business debit and credit cards,

- debit and credit cards connected to foreign currency accounts,

- debit and credit cards that are not valid (i.e. currently blocked or previously terminated or expired)

where can I find the K&H cashback service?

In the K&H mobile bank app, on the K&H+ screen, under ‘K&H cashback’. You can also activate it with the help of Kate, who will direct you to the right screen based on a voice command or a chat message, after you enter/say the word 'cashback'.

If this feature is not yet available in your version, please update the K&H mobile banking app using the buttons below.

how can I activate the service?

Once you have read and accepted the relevant General Contracting Terms and Conditions and privacy notice, you can automatically activate the service if you fulfil the terms and conditions.

are credit card purchases also taken into account in this service?

Yes, purchases made with a credit card that meets the conditions of the service also count.

can it be combined with other credit card discounts?

The service is independent of any other scheme and cannot be combined with other discounts.

can I use a co-card?

Co-card holders can also participate in the programme by activating the service and taking advantage of partner offers. The refunds on purchases will be credited to the main cardholder’s account to which the co-card is connected.

is the service free of charge?

Yes.

how can I get a refund?

After activation, log in to the service and find the preferred partner offers to which you wish to apply the discounts. To get the discount, activate the offer on the cashback screen before you pay with your K&H debit or credit card at the merchant. Read the terms and conditions carefully and observe them when shopping at the merchants who made the activated offers. All you have to do then is wait for your monthly refund.

do I always see the same offers?

No, the offers and the range of products and services vary regularly, and may differ from client to client.

what makes an offer personalised?

The content and duration of offers may vary from user to user. Not all users will receive offers from all merchants participating in the program, as this will depend on the type and frequency of spending.

what to look out for in the offers?

Watch out for the following content:

- the refund rate,

- the offer’s validity period,

- the shop(s) and/or online store(s) where the offer is available;

- conditions, restrictions and other special requirements (e.g. maximum amount of discount or special requirements)

how many offers are included in the service at a given time?

At least 15-20 offers are always included in the service.

what happens after an offer is activated? How many times can you use it and how long is it valid?

The validity period and conditions are stated in the description of the offer.

The offer is valid for all purchases made with your bank card during the discount period, subject to the limit stated in its terms and conditions. Always read the details of the offer carefully.

where can I take advantage of an offer? In a shop or online store?

The conditions are stated in the description of the offer. Unless otherwise stated, the discount is available both in-store and online.

what does the ‘Webshop’ sign mean in an offer? What should I do?

In this case, the discount applies to a purchase made in the merchant's webshop, so you must settle the purchase price as an online card payment. You can only claim the discount in this way, i.e. not by paying to a courier service or any other third party.

when will the refund be credited?

The refund will be credited once a month to your debit and/or credit card account used for payment, i.e. to the payment account linked to your debit card, or to the credit card account. The refund will be credited no later than the 10th working day of the following month. You can check the refund in your account statement.

where can I see the amount of refunds?

The amount of refunds collected in the current month and still to be paid is displayed at the top of the main screen, with the total amount of refunds already paid shown below that.

The time between the purchase and the date when the information is displayed may vary depending on how long it takes for the partner merchant to process the transactions. If required, you may request a detailed breakdown of your monthly cashback amount via K&H TeleCenter.

what should I pay special attention to when paying?

You must use your card directly to pay for the service. Therefore the following payment types are excluded:

- payment from an e-wallet (e.g. PayPal),

- payment to a third party (e.g. courier, other delivery company),

- payment using another application in which the card had been registered previously (e.g. Simple application),

- payment with a card registered under another card

In these cases, there is no information available on the merchants, and it is not possible to link the payment to the corresponding offer.

Payment by card must be made within the offer’s validity period. The date and time of the transaction is the date and time of the card payment as shown in the Bank's system.

When paying, you must pay the full price of the product and/or service, and you must take advantage of the offer directly from the partner merchant.

what is not a direct payment?

- payment from an e-wallet (e.g. PayPal),

- payment to a third party (e.g. courier, other delivery company),

- payment with another application in which the card had been previously registered (e.g. a card registered in Simple),

- payment with a card registered under another card