K&H Goal Savings Account

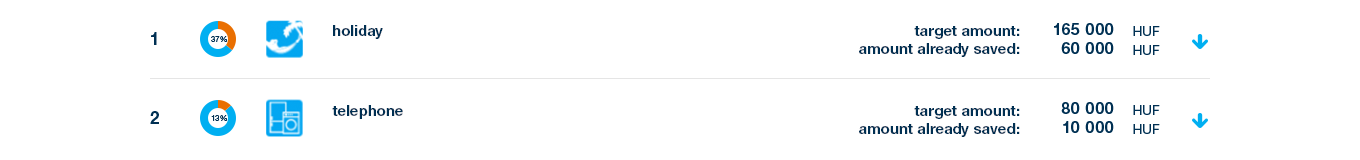

you can set up a dedicated investment goal for each of your future plans, with individual names and icons, allowing you to track the progression of each goal

- you can set up separate goals and track their progression

- you can also open the account via K&H e-bank

details

- you can set up, modify or cancel savings goals in K&H e-bank at any time, and you can also amend the priority of goals, thus allowing you to get an up-to-date picture of the progression of your savings

- by setting up a new goal, you will not create a new account, instead you will simply share the balance of your K&H Goal Savings Account between your various savings goals

- all you need to do is to pay the sum required for the achievement of your goals into your K&H Goal Savings Account every month

- we will help you in the achievement of your goals with regular hints

- minimum opening value and minimum balance: 25 000 HUF

- premium interest is paid if as little as 5 000 HUF is credited to the account each month, as long as there are no debit transactions in the given month and the balance reaches the minimum balance each day

- 2 times a month you can reduce your account balance without losing basic interest, you only have to keep the minimum balance on the account

- you can top up your account balance as you wish, at any time, including by way of paying cash into the account, transferring money from within the bank or from outside the bank or between your own accounts; what’s more, to make sure your savings keep growing, you can also set up a regular transfer order for the benefit of your account

- under our account management campaign, until 30 June 2026 the monthly account management fee of the K&H Goal Savings Account remains 0 HUF (Unified Deposit Rate Index (EBKM): 0,05%-0,15%) for customers who hold a K&H retail bank account, and Fee of K&H Retail HUF Bank Accounts in all other instances

it's worth trying

- you may create, modify or cancel your savings goals in K&H e-bank, and may even change the order of priority of your goals, whilst still being able to track the day-to-day progression of your savings. For instance:

- when you set a new goal, your savings are not placed into a new account – instead, the balance of the K&H Goal Savings Account will be spread among your investment targets

- all you need to do is to deposit the sum required for achieving the dedicated goal by the set time into the K&H Goal Savings Account each month

- we shall regularly give you tips on how to achieve your goals

The interest rates and conditions may be viewed in the Retail HUF Interest Announcement (Annex 4) and in the Announcement pertaining to the bank accounts, deposit accounts, term deposits and cash payments transactions of natural persons (Account Management Announcement), which you can find amongst documents.

The K&H Goal Savings Account is insured by the National Deposit Insurance Fund.

We draw your attention to the consumer protection website of Financial Navigator Advisory of the National Bank of Hungary where you can find useful product descriptions and various applications for comparison (loan calculator, budget calculator for households).