why is it important to keep your software updated?

2023. július 30. - software has an expiry date, too. Did you know that, with each update, your devices become not only more convenient but also more secure?

if you suspect that someone has gained access to

take immediate action!

if you notice that a transaction you don’t recognise has been initiated from your bank account or that unauthorised persons have accessed your bank card or bank account details, promptly report the case to TeleCenter so that they can take steps to block your bank cards, as well as access to your bank account (including your phone number) in order to minimise losses and prevent further fraud. At the same time, you can apply for a replacement card

If you wish to block your bank card for any other reason, you have the following options:

use lawful software on all your devices

please, visit your nearest branch, and reactivate your accounts and cards with the help of our advisors.

phishing is a subset of fraud, one of the biggest online threats today, and one that almost everyone is exposed to. As its name suggests, phishing is an attack aimed at obtaining our data. Quite a few attacks can be prevented by technical means, however, without your involvement, technical means are worth very little. We, at K&H, do our best to protect your money and your data, but one of the key components of that protection is YOU.

phishing is a subset of fraud, one of the biggest online threats today, and one that almost everyone is exposed to. As its name suggests, phishing is an attack aimed at obtaining our data. Quite a few attacks can be prevented by technical means, however, without your involvement, technical means are worth very little. We, at K&H, do our best to protect your money and your data, but one of the key components of that protection is YOU.

one of the most common phishing techniques is for unauthorised persons to try and obtain the bank card details and certain identification data of customers from a phone number that appears to be real, often pretending to be representatives of another bank. It can also happen that they call ‘on behalf’ of another bank and then, once they identify the person as a K&H customer, they ‘transfer’ the call to a K&H ‘staff member’ or immediately redial the customer again, posing as a staff member of K&H.

caller ID spoofing is a special technique that allows fraudsters to modify the caller ID that is displayed on the phone’s screen (for example, to a K&H phone number), hiding the identity of the real caller. In other words, when you receive such a call, the display will not show the real caller’s phone number, but another number that often looks familiar, such as the bank’s phone number. This increases the credibility of the fraudsters and helps them deceive victims. A familiar phone number may appear less suspicious, making it more likely that they can trick victims into providing the information they want.

They typically take the form of letters written in incorrect Hungarian, with typing and spelling mistakes, which

The text of the link in the letter is not related to the content of the letter (e.g. the link in the letter sent on behalf of K&H does not point to kh.hu, but to a completely different page).

due to their nature, these messages typically contain a short, attention-grabbing narrative message and a link (e.g. your package no. 111111111 has been sent). Text messages, like telephone calls, can also come from a phone number that appears to be real. In any case, be suspicious if you receive a text message with content you were not expecting (e.g. if you have not ordered anything and you are still informed about the arrival of a package). To check the link, hold your finger on the link for some time, and you will see the link to which the message actually points. If the text of the link is not related to the content of the message (e.g. the link in the text message is sent on behalf of K&H, and it does not point to kh.hu but to a completely different page), you are almost certainly the target of a phishing attack.

due to their nature, these messages typically contain a short, attention-grabbing narrative message and a link (e.g. your package no. 111111111 has been sent). Text messages, like telephone calls, can also come from a phone number that appears to be real. In any case, be suspicious if you receive a text message with content you were not expecting (e.g. if you have not ordered anything and you are still informed about the arrival of a package). To check the link, hold your finger on the link for some time, and you will see the link to which the message actually points. If the text of the link is not related to the content of the message (e.g. the link in the text message is sent on behalf of K&H, and it does not point to kh.hu but to a completely different page), you are almost certainly the target of a phishing attack.

Inheritance fraud means that fraudsters offer a significant inherited amount, i.e. major financial gain, to those who are receptive to that. In the typical scenario, a message is sent in the name of a foreign lawyer or authority, in which a very high inherited amount is promised in exchange for a participation. Claiming various costs, the fraudsters request the transfer of a low advance payment.

our universal advisors often report a type of fraud that is difficult to prevent because our client intentionally wants to transfer money to the fraudster. In the latest case, our client was contacted by a lady (?) who claimed to be a Hungarian living in Africa. Her family name was the same as our client’s, and the fraudster claimed to be a distant relative. Over several weeks of daily online conversation involving photos generated with artificial intelligence, our client grew to trust the “lady” that she had only heard from in messages. So when the fraudster mentioned that her small child was seriously ill and needed an expensive operation that was performed in West Europe only, our client wanted to transfer a large amount in order to help.

our universal advisors often report a type of fraud that is difficult to prevent because our client intentionally wants to transfer money to the fraudster. In the latest case, our client was contacted by a lady (?) who claimed to be a Hungarian living in Africa. Her family name was the same as our client’s, and the fraudster claimed to be a distant relative. Over several weeks of daily online conversation involving photos generated with artificial intelligence, our client grew to trust the “lady” that she had only heard from in messages. So when the fraudster mentioned that her small child was seriously ill and needed an expensive operation that was performed in West Europe only, our client wanted to transfer a large amount in order to help.

Fortunately, this story ended well because our universal advisor managed to convince our client that this was a fraudulent attempt at obtaining her savings. As the police confirmed this conclusion, our client suffered no damage.

The “Nigerian-type” or “419” fraud is a specific method employed in social media or on online dating portals, when the victims willingly transfer money to the fraudsters. The perpetrator builds up a romantic relationship with the victim, and then comes up with a touching story to ask for money. The deceptive story is supported with a fake social media profile that nevertheless looks authentic.

A client of ours received an unusually high phone bill from his service provider. Upon checking his call list, he found a long call to a foreign (African) number. He remembered a missed call from a number abroad. Unsuspectingly, he had called the number back. The phone on the other side rang for a long time but was not picked up; then the connection was broken. The phone company told our client that he had fallen victim to call-back fraud. The phone connection had actually been made; the call sounds had been recorded and played back by the fraudsters.

A client of ours received an unusually high phone bill from his service provider. Upon checking his call list, he found a long call to a foreign (African) number. He remembered a missed call from a number abroad. Unsuspectingly, he had called the number back. The phone on the other side rang for a long time but was not picked up; then the connection was broken. The phone company told our client that he had fallen victim to call-back fraud. The phone connection had actually been made; the call sounds had been recorded and played back by the fraudsters.

Call-back fraud is rather frequent. The perpetrators make many phone calls from unknown numbers, often from abroad, in order to gain money from their victims. The calls are short and immediately interrupted because the fraudsters want to be called back, so that they can gain income from the high (often premium) rates of international calls. The fraud attempt is successful even if the phone is not picked up despite a long series of rings, if the call is interrupted, or if the line is busy.

Investment fraud is very common. The fraudsters advertise a seemingly attractive opportunity to invest in shares, bonds or cryptocurrencies, often using images of and recommendations by celebrities such as models or athletes. The perpetrators attempt to gain their victims’ money through the promise of getting rich fast.

Consumers and businesses buy and sell more and more goods on the internet. Online offers are often favourable indeed, but beware of fraudsters!

In one of the most frequent schemes, a buyer calls the seller to claim that he has paid for the product, and asks the seller to install a program on his computer or phone in order to “ensure that the payment is received”. The software usually grants remote access to the device. The unsuspecting seller may disclose to the fraudsters the code received in a text message; as a result, the criminals lock him out of his own banking profile, and empty his bank account.

In another type of online marketplace fraud, the seller is informed in a text message that the product has been paid for but he must “accept the amount” by opening a link in the message. Alternatively, the “buyer” recommends a courier service by abusing the name of a well-known and legitimate delivery service (e.g. Foxpost, DHL, DPD, MPL), and sends a text message or e-mail containing a phishing link referring to that provider. The link leads to a false website compiled by the fraudsters, where the seller is requested to enter his bank card data. Then the criminals can abuse the card, e.g. by making purchases. In other cases, the seller is invited to select his account managing bank and then enter his sensitive login data. This false website forwards the data to seller’s bank, and the careless client (seller) gets a legitimate one-time login code (e.g. in a text message) which he also enters on the false site. In that way, the fraudsters gain control of the client’s bank profile, and can immediately steal (transfer) the account balance.

In these scams, the criminals send a text or e-mail message in the name of a non-banking service provider, asking you to confirm your data, pay an overdue amount, receive a parcel or a transferred sum, or suspend the service. Under that pretext, they request bank account or card data, personal data, or a money transfer. These messages often include links that seem to lead to the legitimate provider’s website but actually take you to a malicious site, or install malicious software on your device.

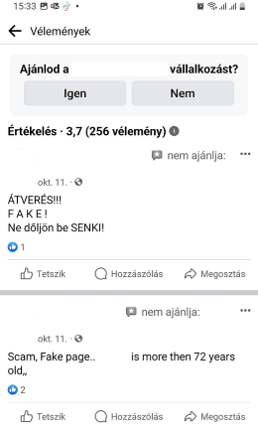

Cybercriminals know that service providers increasingly use social media to keep in touch with their clients, even for the purposes of complaint handling or problem solving.

The perpetrators monitor complaints made to service providers in social media, and then pose as a representative of a company by copying a real representative’s profile or creating a similar one. They contact complaining customers and ask for sensitive information such as personal, banking or login data, ostensibly in order to resolve the issue. With that sensitive information, they can access the client’s bank account or various online accounts.

Fraudsters employ various methods to make you disclose your personal data; for example, they may offer you a job. Then they use the data for unauthorized purchases, or they open a bank account, buy telephone subscription, borrow money, execute illegal business transactions, or sell your data to other fraudsters.

K&H Bank uses two-factor authorisation for online login and transaction approval. During an identification in text message, users are required to enter not only their password but also a code received in the text message. This secondary authentication request appears on your phone’s screen even if someone else has been trying to make a transaction.

Phoney WiFi networks can be so sophisticated that a general user would hardly spot them. In such a scam the attackers set up a fraudulent WiFi hotspot bearing the name of a well-known and legitimate one. Then they invite potential victims to connect. They tap into the communication and collect sensitive information such as usernames and passwords while the users often do not even detect the attack.

Phoney WiFi networks can be so sophisticated that a general user would hardly spot them. In such a scam the attackers set up a fraudulent WiFi hotspot bearing the name of a well-known and legitimate one. Then they invite potential victims to connect. They tap into the communication and collect sensitive information such as usernames and passwords while the users often do not even detect the attack.

Scammers use phishing e-mails or text messages to install malicious code on your device, that may allow them to look for and collect information such as login data. Such pieces of code are usually installed without the user’s knowledge when the user clicks on a link in a phishing message posing as a legitimate notification or installs an application that contains malicious code. As the user is not aware of being spied upon, they may disclose sensitive information such as login data and financial information.

Large companies, as well as small and medium-sized enterprises, are paying more and more attention to protection against cyber-attacks, as these can not only compromise their own data, but also those of their customers and partners. Cyber-attacks can not only cause financial damage, but can also harm the reputation of the company, and by reducing customer confidence affect the competitiveness of the market player in question.

Optimally, businesses will make greater efforts to protect their information security than private individuals, but attackers also stand to gain significantly more from businesses, which need to be aware that they are typically more exposed than private individuals.

In the majority of cases, the attacks target employees to obtain data, taking advantage of the fact that individuals are less security-conscious. Thus by training their employees to recognise and avoid attacks, companies are protecting their employees as private individuals and through them also the company's assets. Attacks targeting private individuals, how to recognise them and how to defend against them are described at www.kh.hu/web/eng/security-in-your-finances. Below you can read about attacks specifically targeting businesses.

The spread of digitalisation is creating new opportunities for fraudsters, who are using a wide variety of methods to defraud companies and extort money from them using false information.

One of the most common types of abuse that companies are facing today is the so-called “fake management instruction”, targeting an employee authorised to make payments and tricking them into paying a false invoice or initiating an unauthorised transfer. They rely on employees trying to quickly follow instructions that come directly from senior management.

By applying appropriate controls, falling victim to such fraudulent practices can be prevented or reduced.

The most common source of trouble is the possession of conflicting privileges

Having conflicting privileges means that a single individual has multiple privileges that allow them to perform unauthorised activities without being subject to proper controls, thus posing a risk to attacks by fraudsters.

Four-eye controls are procedures whereby two independent individuals are required to perform a transaction or operation, thereby:

The bank strongly recommends that business clients set user and signature limit points in K&H Electra so that, where possible, more than one user is required to initiate a payment order, or more than one user is required to sign it, at least for higher value orders.

The K&H Electra system uses signature points to control the initiation of payment orders. This points matrix can be customised according to two criteria:

User and signature scores can be queried with the Self-administration Privilege and modified with the Company Privilege.

|

Query |

Web Electra |

Installed Electra (Client module) |

|

User’s signature score |

Settings -> Users -> Account privileges |

Administrative instructions -> New order -> Modify user -> Account privileges |

|

Account-level limit setting |

Settings -> Signature limits |

Administrative instructions -> New order -> Signature limits |

Social engineering is a collective term for attacks that exploit certain human characteristics and people’s current states of mind. In many cases, the characteristics in question are very useful for a particular job, but it is important to be aware that they carry a certain risk. For example, in the case of customer service staff, helpfulness is very commendable, but in an attack it can be easily exploited by a fraudster: all they need to do is simply ask for help, advice or information. Employees particularly at risk of social engineering attacks include staff in human resources, IT, customer service and finance, as well as senior management assistants, PR and marketing professionals.

Some social engineering attacks are physical; for example, an attacker may impersonate someone else (external IT professional, auditor, cleaner, guest, journalist, student writing their thesis, etc.) to gain access to the company, from where they can exploit the staff’s lack of security consciousness to collect data, documents, or even equipment (e.g. a laptop, phone, access card, etc. left in the office during lunchtime), go through bins, take a back-up of unlocked devices or leave infected media in places where staff can easily find them. The prevalence of social engineering is illustrated by the fact that each of the above-mentioned types of attack has its own specific name.

Remember that you are the key: your organisation's defences are as strong as those of its weakest link, i.e. its people.

Teach your colleagues to regard strangers and unusual requests with healthy suspicion, not just online but in the physical world too. For larger companies, we recommend training security staff in this, and establishing an access procedure, but even for small and medium-sized businesses where the staff know each other, escorting guests can be a solution as well as a polite gesture. Emphasis should be placed on ensuring that all your employees are aware that they could be a target, and could be used to attack the business itself.

CEO fraud, or whaling, is an attack targeting senior managers in an organisation.

Typically, such attempts are preceded by a lengthy research process to ensure that the senior manager or their assistant under attack takes the bait. CEO fraud emails are written in perfect language, containing information which seems important, so they will almost certainly be opened. Often, they refer to or steal the identity of an existing contact, and the sender of the email is not suspicious. In many cases they contain an attachment, and if you examine the link you will find that the attacker is concealing the actual URL to which the link points. In addition to financial gain, the aim of these attacks is in most cases to gather as much information as possible (e.g. about the organisation's operations in preparation for a subsequent larger-scale attack).

With the rise of artificial intelligence and deep fakes, it is increasingly easier to carry out attacks where the attacker impersonates a senior executive, using their voice and image, and requests information or the transfer of sizeable funds in a video conversation.

One of the basic rules of defence is to ensure that as little is known about you as possible. Carefully separate your work and private life! As a senior manager, it is particularly important to pay attention to visibility settings on social networking sites. Find the right need-to-know balance: post only what is relevant to your business, never share more than you absolutely have to, and try to keep your voice and face in public forums to a minimum.

In particular, as a manager, make sure that you follow all the security rules you expect from your colleagues: in your case, even stricter controls may be justified, as a successful attack on you could cause serious damage.

Always check or double-check enquiries. It pays to be careful: call back the person claiming to be an existing contact or the colleague in question using a phone number you know. It only takes one phone call for you to check that you have indeed been contacted by the person who was supposed to have sent the email or called you, and you can save yourself from a major loss.

A ransomware attack is a cyber-attack in which an attacker installs malicious software on a target's computer or network that encrypts data. The attacker then demands a ransom to recover the data. Ransomware attacks are often made via phishing emails containing malicious attachments or links and are perhaps the most blatant example of why it is important to keep your staff’s security awareness up to date. It only takes one careless colleague to cause serious damage to a business that may lose data as a result of the attack, and paying a ransom is no guarantee that the attackers will reinstate the data.

Anti-virus software is an effective defence against known ransomware, but a solid, practical understanding of phishing signs can protect against new ransomware attacks that only emerge later. Phishing signs are discussed at www.kh.hu/web/eng/security-in-your-finances. Keep in mind that there is no 100% protection, but in the event of a ransomware attack, data can be recovered from backups that are created and checked regularly.

Attackers issue an invoice in the name of a business’ partner, sometimes even drawing attention to the fact that the account number has changed.

Such attacks are relatively easy to thwart if your finance staff know that in such cases they need to check that the invoice is genuine. The easiest way to do this is to check that there is indeed an agreement or contract with the company issuing the invoice, or to double-check the invoice number, perhaps by a phone call. For existing partners, the procedure is even simpler: if the invoice number changes, verify it.

A DDoS (distributed denial-of-service) attack is a cyber-attack in which an attacker uses multiple computers or devices to generate large amounts of traffic to a website or server to overload it and prevent it from functioning normally. DDoS attacks are often aimed at crippling companies' websites or online services, which can result in loss of customers, revenue and reputation, but it should also be borne in mind that DDoS attacks are sometimes used by hackers to “mask” other attacks.

The “captchas” already used on many websites can offer protection against requests from bots. For applications that are likely to have high traffic, technical solutions to ensure load balancing should be considered.

It is impossible to completely eliminate cyber-attacks, but businesses can take steps to reduce their risk and mitigate their impact. The cornerstone of protection is that the business has an information security strategy that clearly defines the protection objectives to be achieved.

The suggestions listed below provide practical help for day-to-day protection against attacks:

E-bank or mobile bank activation: when an e-channel is being activated, we will send you a message in case of authentication device registration

First login to e-bank or mobile bank: we will send you a notification on the first login to your e-channel:

If you did not perform this login, please call K&H Corporate Customer Service immediately on +36 1 468 7777 or on+36 1 468 7755 to keep your account safe.

CyberShield transaction monitoring notification: as a debit card holder of a business with less than 10 employees and an annual turnover of less than EUR 2 million, you will receive a free notification when we detect a debit transaction of minimum HUF 15,000 initiated using a business debit card of yours. This message does not contain the details of the transaction; the purpose of the notification is to ensure that you immediately become aware of a transaction that was not initiated by you, so that you can take action to ensure the security of your account/bank card. For detailed information on Cyber Shield transaction monitoring notifications, please visit https://www.kh.hu/biztonsag-a-penzugyekben/kiberpajzsertesitesek.

In K&H Electra, a new limit management option has been available since 23 September 2024, which represents another step towards safer banking.

The new feature allows you to determine, per account, how many signature points you require from users to approve payment orders between certain (from to) amount ranges, i.e. you can use scores to control how many signers are required to initiate an order. The default setting is a total of 10 points, which can come from one signer (acting alone) or from multiple signers.

For example, let us say that to approve payment orders of HUF 0-1,000,000, 5 signature points are required, while orders from HUF 1,000,001 require 10 signature points. In this case, order (A) for HUF 500,000 can be approved by a single user who has 5 signature points, but they cannot sign order (B) for HUF 2,000,000 alone. Thus order (B) typically requires either two users with 5 signature points each or a single user with 10 signature points.

Please consider your company's operations in terms of the value of your payment orders and your approval structure, and take advantage of the protection offered by the setting of limits accordingly. We recommend restricting limits to match your payment habits, and at the same time prevent the execution of unusual payment transactions. Security is best ensured by signature limits that suit your own operations, so please consider your company's planned activity per account and set limits accordingly, regularly maintaining and reviewing them and changing them as necessary.

The new function is accessible on the client-side administration interface (under Settings/Privilege Management/Signature Limits). To set or change limits, you are required to have 'Company privilege'. If you wish to apply a more complex structure than 4 amount ranges per account, you must still contact K&H Corporate Customer Service staff, as such a complex limit structure cannot be modified via the interface.

To ensure that your assets are managed more securely, we also recommend that you regularly review your users’ privileges and signature points, which you can still do in Settings/Privilege Management.

Make sure your contact data is correct! Instead of central contact information, provide the bank with the most up-to-date contact details specific to each user wherever possible. This will ensure that any alerts or registration or information messages are always sent to the right person. Pay particular attention to the phone numbers for mobile banking and electronic banking applications (e.g. ViCA)!